Saturday, November 17, 2018

Islamic perspective of Consumption and Its Relevance in Development - Basith Rahman Wafy

About the author:

Basith

Rahman Thottathil

Post Graduation in the faculty of Quran Interpretation -Wafy Campus,Kalikavu.

Post-graduation in MA Economics under Annamalai University.

The

Author can be reached at:

Address:

Thottathil House, Velluvangad P.O, Malappuram Dt, Kerala, India, 676521

Phone:

8589841453

Email:

basitht16@gmail.com

Introduction

بسم الله الرحمن الرحيم

The major economic activities fall into four stages. They are production,

exchange, distribution and consumption. The consumption being the last stage of

an economic activity and all these stages are interrelated, the consumption

plays a significant role in determining the stability of an economy. It controls the proportion to be produced, the market to

where it be exchanged and the amount of dispersion in distribution.

The Islamic perspective of consumption turns out to be advisable when

all discussions regarding welfare economics conclude on the need for reduce in the

disparity of distribution. It is the sole reason and result of bad consumption

behavior of the society. However, the disparity of distribution can be reduced

by well-defined guidelines for consumption. The modern theories on consumption stand

for the existence of free market where demand and supply determine the quantity

of production and its price disregarding the needs of all members of the

society. Nevertheless, Islamic perspective of consumption, tries to guarantee

equal distribution of consumption power for all class of society, by giving

guidance to the society's consumption behavior and manipulating their spending.

The important sources of Islam Quran and Hadith directly pointed into this view

of point multiple times.

Consumption

is the action of using up a resource. It is the final process of an economic

activity begun with earning and acquisition of wealth. Consumption stands for

expending of wealth for satisfaction of human wants such as food, clothing,

housing, education, health, and other family needs. In other words, consumption

is the process of utilizing the wealth, for meeting unlimited wants.

Neoclassical (mainstream) economists generally consider consumption

to be the final purpose of economic activity, and thus the level of consumption

per person is viewed as a central measure of an economy’s productive success[1].

Consumption plays a vital role in both micro and macro-economic analyses. As

macroeconomics is concerned with aggregate analysis of an economy, aggregate

consumption is needs to analyze the aggregate saving level. Both saving and

consumption are interrelated, as both are two dimensions of income. Consumption

determines the level of saving. As aggregate saving determines the amount of the

capital in a country the aggregate consumption happens to be the focus of macroeconomics.

Microeconomics deals with the individual parts of an economy rather than the aggregate

level. Consumption as a main determinant of individual stabilization, it becomes

the core of microeconomics. An individual's economic stability is measured by

evaluating consumption power of that person. Some individuals are poorer when

their income not covers even his basic needs. Some others are rich when they

get excess level of income than his consumption. According to this measuring consumption is

the main determinant of individual surplus and economic stability. The level of

individual savings needs to be evaluated, as it is the remaining amount of

income after the spending in consumption. Micro economists also have utilized

these data to examine relations between consumption and other microeconomic

behavior such as job seeking or educational attainment.

The basic problem faced by an individual consumer or country is how

to satisfy unlimited wants with limited resources. If each consumer has

unlimited money income and limited wants, then there would be a need for

economizing. Consumers are compelled to determine their behavior in accordance to

the limited financial resources. The consumer makes purchases to maximize satisfaction,

which subject to the constraint that these purchases should not exceed the

consumer's limited money income. As far as a country is concerned, it is essential

to ensure the attainment of basic satisfaction for all individuals of a country.

Whenever it fails to do it, the economy will face dangerous problems such

poverty ,deaths caused by it and the likes.

The UN human development report for the year 1998 points out the

pathetic conditions of today's consumption behavior and it states:

"today’s consumption is undermining the environmental resource base. It is

exacerbating inequalities. And the dynamics of the

consumption-poverty-inequality-environment nexus are accelerating. If the

trends continue without change — not redistributing from high-income to

low-income consumers, not shifting from polluting to cleaner goods and

production technologies, not shifting priority from consumption for conspicuous

display to meeting basic needs — today’s problems of consumption and human

development will worsen"[2]

As the UN report describes the negative effects of bad consumption behavior

of society it calls for rearrangement of the economic consumption behavior in

no time to attain a welfare economics condition where there is no wide-ranging

gap between the poor and the rich. Nevertheless, it is a difficult task. Direct

intervention of governments more than a specified level will adversely affect the

economies. Therefore, the next best alternative is to maintain consumption behavior

by counseling individual consumers as it is a psychological phenomenon.

The UN human development report emphasizes on some remedial measures

for a better consumption behavior. Consumption must be shared, strengthening,

socially responsible and sustainable.

·

Shared

means ensuring basic needs for all.

·

Strengthening.

Building human capabilities.

·

Socially

responsible. So the consumption of some does not compromise the well-being of

others.

·

Sustainable.

Without mortgaging the choices of future generations.

Factors

Affecting Consumption

Income:

Income of an individual or community is the main determinant of

consumption. It determines the propensity to consume. When income rises

consumption also rises but in a proportional level, when income decreases

consumption also decreases to a specified level. It shows that an individual

will spend upon basic needs even if his income is zero. To attain this he will

borrow from other financial institutions or persons.

Distribution

of income:

An economy is a joint work of individuals, as wealth is the blood

and power of an economy, it determines in which level an individual

participates in economic activities. A low-level income or wealth individual

sacrifices more of his wants than that of a rich person. As the central problem

of an economy is, 'limited recourses and unlimited wants' some class of society

will face dirty hands of poverty when their income fails to compensate even

their basic needs. In this perspective, The Distribution of income directly

affects consumption power of individuals. By regulating distribution of income,

consumption can be moderated.

The

rate of interest

Savings directly depend upon interest rates. When the rate of

interests rises, saving will increase and consumption will fall, for both are

two different utilizations methods of income. At high rates of interest people

often curtail their wants to save more, because interest based savings provide riskless money,

which is useful for future consumptions. When interest rates decreases

consumption increases. Due to this, interest rates affects the consumption

spending directly in an economic system where interest based banks work.

The consumption has to face the constraints of satisfying unlimited

wants with limited resources. When someone consumes more and more of the resources,

someone else will face the scarcity for their consumption materials. It

necessitates the need for a consumption order in an economy to fulfill the

basic needs of all individuals.

The Islamic economy considers individual wealth and gives him

complete security; it is a concern from the part of God. Look into the words of

Quran:

آمِنُوا بِاللَّهِ وَرَسُولِهِ وَأَنْفِقُوا مِمَّا جَعَلَكُمْ

مُسْتَخْلَفِينَ فِيهِ"[3]

“Believe in Allah and his messenger and spend out of that in which

he has made you successors. For those who have believed among you and spent,

there will be a great reward”[4]

This theory of wealth in Islamic perspective compels all

individuals to keep a hierarchy order of consumption for considering all

individuals in an economy. Islam recognizes that man has certain needs, some of

which are more important and others are less important.

Daruriyyath

(necessities)

Necessaries are those wants whose satisfaction is essential, and without

considering it, man cannot survive such as food, cloth and shelter

عَنْ عُثْمَانَ بْنِ عَفَّانَ أَنَّ النَّبِىَّ -صلى الله عليه وسلم-

قَالَ « لَيْسَ لاِبْنِ آدَمَ حَقٌّ فِى سِوَى هَذِهِ الْخِصَالِ بَيْتٌ

يَسْكُنُهُ وَثَوْبٌ يُوَارِى عَوْرَتَهُ وَجِلْفُ الْخُبْزِ وَالْمَاءِ »[5].

Uthman ibn Affan reported that the prophet, peace and blessings be

upon him, has said:“there is no right for the son of Adam except in these

things: a house in which he lives, a garment to cover his nakedness, a piece of

bread and water.”[6]

Islamic economics promotes the society to take the care of those

who suffering from incapacity to attain this necessary consumption. An individual

in a society has no moral right for consumption more than his needs when there

is someone suffering from lack of basic needs. The prophetic words describes

this:

ما آمن بي من بات شبعان وجاره جائع إلى جنبه وهو يعلم[7]

“The one who sleeps with a full stomach

knowing that his neighbor is hungry doesn’t believe in me”.

According to this theory, Islamic economics move forward to the full-fledged

economic development, where all individual consumer in the economy will pay

attention to those lives around them and ensure his status in achieving basic

needs.

Kamaliyyah

(Perfections)

These are the needs that are above necessities which relieve

hardships and add beauty and elegance to life without breaking the rules of

moderation as defined by the Sharia. A man’s ordinary food, clothing and

shelter are bare necessaries for his survival, but good food, good clothes and

a good house are his comforts. Enjoyment of comforts is permissible in Islam.

وَأَمَّا بِنِعْمَةِ رَبِّكَ فَحَدِّثْ (11)[8]

“And proclaim the grace of your lord”. (God has

provided you different kinds of Nihmah' (blessings), proclaim those by wearing

good dress, eating good food...etc.)

Israf

(luxury)

Excessive expenditure on unnecessary and superfluous wants is

called luxury. Luxury life is prohibited by Islamic finance for the better

consumption experience for all individuals. If some individuals in a society

consumes more and more of luxury goods, it will affect entire economy

negatively. By realizing this, modern governments impose excess tax on luxury

goods.

ويقول

الله سبحانه : " يابني آدم خذوا زينتكم عند كل مسجد وكلوا واشربوا ولا

تسرفوا إنه لا يحب المسرفين (31)"[9]

O children of Adam, take your adornment at every Masjid, and eat

and drink, but be not excessive. Indeed, He likes not those who commit excess.[10]

The market determines which quantity of goods to be produced. When

demand of a specific good increases the industry determines to increase in the

production of that good. When some individuals in an economy consumes more of a

good, its supply fails to compensate the market demand. The industry increases

its price and reduces the demand.

The Islamic economics mandate the consumers to keep a consumption

hierarchy along with their consumption.

1.

Consumption as Obedience to God

The Islamic consumption theories distinguish from that of other

systems in many ways. The view of consumption in Islamic perspective is worship

and obedience to the almighty God. Unlike conventional consumption theories that

are based on the utility where individuals spends their income only for

satisfying the human needs, and any failure to achieve this material

satisfaction is considered as deficiency in individual consumption the Islamic

perspective of consumption such as the pursuit of livelihood and the consumption

of food, cloth, shelter..etc are considered as obedience to almighty God. Which

is also a reason to be rewarded if he did it for the sake of almighty Allah.

Allah almighty says:

وَهُوَ الَّذِي سَخَّرَ الْبَحْرَ لِتَأْكُلُوا مِنْهُ لَحْمًا

طَرِيًّا وَتَسْتَخْرِجُوا مِنْهُ حِلْيَةً تَلْبَسُونَهَا وَتَرَى الْفُلْكَ

مَوَاخِرَ فِيهِ وَلِتَبْتَغُوا مِنْ فَضْلِهِ وَلَعَلَّكُمْ تَشْكُرُونَ (14)[11]

(“and it is he who subjected the sea for you to eat from it tender meat

and to extract from it ornaments which you wear. And you see the ships plowing

through it, and [he subjected it] that you may seek of his bounty; and perhaps

you will be grateful”)[12]

The prophet Muhammad (pbuh) says about this:

وعن النبي صلى الله عليه وسلم ما أطعمت زوجتك فهو لك صدقة، وما أطعمت

ولدك فهو لك صدقة، وما أطعمت خادمك فهو لك صدقة، وما أطعمت نفسك فهولك صدقة"[13]

(“ the prophet -peace and blessings of Allah

be upon him- says that: the feeding of your wife is a charity to you, and if

you feed your child it is also a charity, and if you feed your servant it is

also a charity, if you feed yourself it is also a kind of charity”.(

According to the above-mentioned sources, all kinds of consumptions

are to be rewarded by almighty Allah, if it happens for the sake of Allah. This

kind of belief in the minds of a consumer leads him to the welfare and

developed economics, where he will spend his money solely based on the

guidelines of almighty god, which is more appropriate for a developed economy.

2.

Consumption of Lawful Things

The Islamic economy ensures the security of the consumers in

different parts. As the consumption is the main part of an individual's life,

and the determinant of all economic activities, consumption needs to be

classified into lawful and unlawful. When the conventional consumption theories

are based on satisfaction of consumer and the utility there is no boundaries to

consume for an individual. However, the Islamic economics prohibits consumption

of goods for the security of consumers. There is two type of consumer security.

I.

The security for the consumption power (the spending on consumption

must be lawful)

This rule of Islamic economics ensures the security of consumption

power for an individual. A Muslim consumer fears the including unlawful wealth

in his consumption as it is prohibited by the Quran and Sunnah. The consumer’s

wealth is safe to an extent in Islamic economy by enacting this kind of a rule,

apart from this, Islam orders all

individuals to keep their wealth in safe place.

II.

The security for consumers health (prohibition of harmful goods for health)

The Islamic economics ensures the health stability of فاث individuals by enforcing different kinds of

regulations in consumption. The work force is the basics of an economics system;

a healthy economy will not emerge in a poor health society. Islamic economics

prohibits some kind of goods, which are harmful to the health.

يَاأَيُّهَا الَّذِينَ آمَنُوا إِنَّمَا الْخَمْرُ وَالْمَيْسِرُ

وَالْأَنْصَابُ وَالْأَزْلَامُ رِجْسٌ مِنْ عَمَلِ الشَّيْطَانِ فَاجْتَنِبُوهُ

لَعَلَّكُمْ تُفْلِحُونَ[14]

“Oh you who have believed! indeed,

intoxicants, gambling, [sacrificing on] stone alters [to other than Allah ],

and divining arrows are but defilement from the work of Satan, so avoid it that

you may be successful”.[15]

An economy spends much more proportion of its wealth for the

treatment of health problems and it can save and utilize this by preventing

illness and health issues. The over consumption of food being the main cause of

illness to the body, Islam strictly advises to be moderate in food consumption

and to avoid goods prohibited by the Quran and Sunnah.

III.

The security for consumers faith and belief (the consumption itself

must be lawful)

The basic concept of Islam by its orders is to realize who is ready

to be obedient to the God almighty. Sometimes the human cannot understand the

reasons for the ban of some kinds of goods, but a Muslim who believes in Allah should

obey it and realize that these orders are enforced for the welfare of the man.

Some kinds of goods and services are prohibited

for direct security of faith and belief, for e.g.: the service of astrology.

3.

Abolition of Riba

The interest is earning of money in a riskless manner. The money

holder always earns the money with his money without fearing any reduction. It

widens the gap between the haves and have-nots. The poor people borrows money

from the money holders for their necessities, money holders receives the

interest when the poor gives a part of their earnings along with the capital.

The flow of consumption power always goes to one side without any reduction. It

is harmful to the society where a small class of people will become wealthier while

the other class of the society becomes poorer. This leads to a situation in

which the individuals hesitates to provide money for borrowers without

interest. Consequently, the class of low consumption power people remains poor

or they becomes zero consumption power people as they cannot engage in any

production proposes.

By realizing these kinds of unfairness, Islamic economics prohibits

the Reba and all of its kinds by the Qur'an, Sunnah, consensus and reason.

Allah says in his Quran:

وَأَحَلَّ اللَّهُ الْبَيْعَ وَحَرَّمَ الرِّبَا[16]

"Allah has permitted trade and has

forbidden interest."[17]

The prophetic Hadith says that:

أنّ رسول الله صلى الله عليه وسلم لَعَنَ آكِلَ الرِّبَا، وموكله

وَكَاتِبَه، وشاهديه وَقَالَ: هُمْ سَوَاء[18]

The messenger of Allah (peace and blessings of Allah be upon him)

cursed to eat usury, its client, its writer, and its witnesses. And he said:

all are same..[19]

The Islamic economics always promotes risk based money investing

where the there is a chance to incur loss or earn profit. It is motivational

for an economy as the money holder pays his concentration along with his wealth

and he bears the risk of loss if it was the result. Islamic banking system

provides different kinds of risk based money investing like Mularaba and Musharaka...Etc.

It enables the sharing of consumption power between different classes of a society.

In addition, it provides relaxation for the borrowers for the production purposes

as it provides risk sharing. As a result, the market will expand by the

entrance of new industries and fresh ideas and it will provide a better

consumption atmosphere consequently which will lead to the development of

entire economy.

4.

Abolition of Monopoly

The monopoly is in which a single seller (firm) controls the entire

supply of a commodity that has no close substitutes.[20]The

monopoly power is harmful to the society as it violates the consumption methods

of society. The monopolists have the

power to raise prices and control supply of goods at their will as it has no

close substitutes. The existence of restrictions on entry to new firms

characterizes a monopoly.

The Islamic economy allows complete freedom for the market without

any restrictions from the part of the government in the wake of saving the monopolists.

The Islamic economy abolishes the monopoly power in the market. The Arabic word

for monopoly is "Ihtikar" which comes from the word "Hakr",

which means collecting and controlling goods. 'Ihtikar' used by scholars of Islamic

jurisprudence to assert the privilege to collect and control of goods in an

effort to anticipate the need when price increases. In other words, means the

process of monopolizing Ihtikar products to result in price increases.

قال رسول الله صلى الله عليه وسلم من احتكر فهو خاطئ[21]

The messenger of God says:"he who hoard goods, then he sinned"[22]

According to this Hadith, 'Ihthikar' is prohibited when the

consumers face trouble in purchasing. By abolishing this kind of power, Islamic

economics ensures the security for consumers in the market.

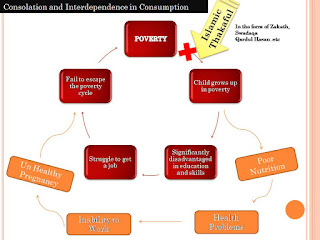

The poverty cycle is a major matter of concern in the case of

individuals as well as in the case of undeveloped nations. The poor families are poor because they are

poor. Low level of income leads to low level of investment. It is also seen in

the case of educational qualifications. Poor families are unable to attain

better education for their younger generations for it is very costly. It also causes

to poverty as the new generations from these families also to find better

employments due to the lack of better educational qualifications. Problems

related malnutrition also causes to the inability of the working force. The

poverty leads to more severe levels of poverty when their income could not

cover even their basic needs. In situations like this, how can a poor invest in

a profitable business? The society hesitates to lend them money as they have no

valuable wealth or future profitable sources to bring the money back. Only the

rich class of society can make money with their money by investment.

The breaking of this poverty cycle is the only way to eliminate the

poverty. Understanding this, various governments of different states and

countries work hard to break this cycle by introducing diverse array of tools.

The Islamic economics puts forward a couple of valuable measures to break this

poverty cycle.

By the payment of Zakath and Swadhaqa the breaking of this poverty

cycle is possible to some extant as it tends to help the destitute out of wealth

of the rich. It tries to the transfer the consumption power from the riche to the

poor. The Islamic economic system uses

two main consumption power-sharing methods.

1)

Consumption Power Sharing with the Government Intervention

The Islamic economics compels the riches to pay 'Zakath'. It is a

proportion of wealth, which exceeds a certain limit. The zakath system of Islamic

economics is a way for governments to intervene in the individual consumption

power. When someone hesitates to pay the 'Zakath' the 'Qazi' (ruler) have the

right to compel them to pay the 'Zakaths'. Allah says in the Quran:

"وَأَقِيمُوا الصَّلَاةَ وَآتُوا الزَّكَاةَ وَمَا تُقَدِّمُوا

لِأَنْفُسِكُمْ مِنْ خَيْرٍ تَجِدُوهُ عِنْدَ اللَّهِ إِنَّ اللَّهَ بِمَا

تَعْمَلُونَ بَصِيرٌ (110)[23]

"And perform as-salat (iqamat-as-salat), and

give Zakat, and whatever of good (deeds that Allah loves) you send

forth for yourselves before you, you shall find it with Allah. Certainly, Allah

is all-seer of what you do."[24]

2)

Consumption Power Sharing without Government Intervention

Islamic economics also promotes different kinds of voluntary wealth

sharing. Which have no direct government intervention.

لَنْ تَنَالُوا الْبِرَّ حَتَّى تُنْفِقُوا مِمَّا تُحِبُّونَ وَمَا

تُنْفِقُوا مِنْ شَيْءٍ فَإِنَّ اللَّهَ بِهِ عَلِيمٌ[25]

“Never will you attain the good [reward] until you spend [in the

way of Allah] from that which you love. and whatever you spend - indeed, Allah

is knowing of it”.

In short, Islamic economics uses different kinds of consumption

power sharing. The motive of both Zakah and Swadhaqa is the blessings of

Almighty God. Although Allah puts forward some remedial measure for the

stability of the economy, some people get away from their faith in God and they

hesitate to share their money. By enacting government intervention method in

Zakah system, along with the motivational methods of Quran and hadith both

methods are essential to ensure the development of an economy. For the

individuals are of different kinds and their attitudes may differ in various

circumstances, but the economy always needs the sharing of consumption power

between individuals to realize the development of a society.

6. Moderation in consumption

Moderation is matter of concern in

everything. Whatever crosses its limits becomes a string of guilty, be it by

increase or decrease. Islam always promotes and stands for moderation in every aspects

of life. Allah say in his Quran:

(وَكَذَلِكَ جَعَلْنَاكُمْ أُمَّةً وَسَطًا)[26]

“And thus we made you a moderate society”[27]

An individual in an Islamic economy is

not free to choose what else he needs from the market to own without

considering the economic situation of society. As a regulation of consumption,

first of all Islamic scripts stands as a psychological counselor, for the

theory of satisfaction of consumption being a psychological phenomenon. Allah

Says:

(وَالَّذِينَ إِذَا أَنْفَقُوا لَمْ يُسْرِفُوا وَلَمْ يَقْتُرُوا

وَكَانَ بَيْنَ ذَلِكَ قَوَامًا)[28]

“And [they are] those who, when they

spend, do so not excessively or sparingly but are ever, between that, [justly]

moderate”[29]

Moderation in consumption is major part

of Islamic perspective of consumption. Consumption behavior of Muslims must be

within two ends of the extremes. Two extreme points of consumption behaviors

stands against the sound economic system and the development of society. If

Market fails to find adequate demand for the available supply, it will result

in the failure of economic system. If market demand increases more and more and

market fails to find enough supply, it will lead to continues increase in the

price level, it is known as Inflation.

Conclusion

The dealings of Islamic economics with

consumption is very different from that of conventional economic trends.

Islamic economy aims at well-rooted development of the society by regulating

the consumption behavior of the society. It gives importance to the welfare of

society rather than Individual surpluses. Islamic Economics applies several

kinds of regulations for the direction of consumption. The first and important

method taken by Islamic economics is counseling the minds of people for the invention

of a better economic system along with putting measures to gain the rewards

from the God. Islamic economics puts forward a hierarchy of consumption seeking

consideration of all individuals in a society. Consumption as a tool to

regulate economic activates, Islamic economics aims at turning consumption

behavior of society towards the development.

References:-

Quran Shareef

Swaheeh

Muslim

Swaheehul Bukhari

Sunan al-Tirmidhī

Al

kabeer- Twabrani

The Noble Quran, Published by Dar-us-Salam Publications

General Theory Of Employment Interest And Money

- John Maynard Keynes

Theory of the Consumption Function - Milton

Fridman

The International journal of Human Rights,

Vol:3, No:2, (Summer 1998) -Published by Frank Cass, London.

https://www.britannica.com/

[1] https://www.britannica.com/topic/consumption

[2] The International journal of Human Rights, Vol:3,

No:2, (Summer 1998) pp.69-83. Published by Frank Cass, London.

[3] سورة الحديد، الآية 7.

[4] Chapter No:17, Verse No:7

[5] سنن الترمذي، ج9،

ص114، رقم 2512.

[6]Sunan al-Tirmidhī (2512)

[7]الطبراني، الكبير 751

[8]سورة الضحى، الآية 11

[9] سورة الأعراف، الآية

31

[10]

Chapter No:7, Verse No:31

[11] سورة النحل، الآية 14

[12] Chapter No: 16, Verse No: 14

[13] رواه أحمد في مسند المقداد بن معدي كربة، ج4، ص131

[14]سورة المائدة، الآية 90

[15]

Chapter No:5, Verse No:90

[16] سورة البقرة، الأ275

[17] Chapter No:1, Verse No : 275

[18] صحيح مسلم، كتاب

المساقاة، باب تحريم الإحتكار في الأقوات، رقم1598

[19]Swaheeh Muslim, 1598

[20] Introductory micro and macro economics, Dr.

VK.Vijayakumar, Excel publishers - Chapter No:6, page1

[21]صحيح مسلم، ج10، ص443، رقم: 4206

[22] Narrated by Muslim, Vol 10, page 443, No:4206

[24] The Noble Quran, Published by Dar-us-Salam Publications,

Al-baqarah-110

[25]Chapter

No:3, Verse No: 92

[26] سورة البقرة، الآية 143

[27]

Chapter No:2, Verse No143

[28] سورة الفرقان، الآية 67

[29]

Chapter No:25, Verse No:67

Subscribe to:

Post Comments

(

Atom

)

No comments :

Post a Comment